Mid-Year 2023

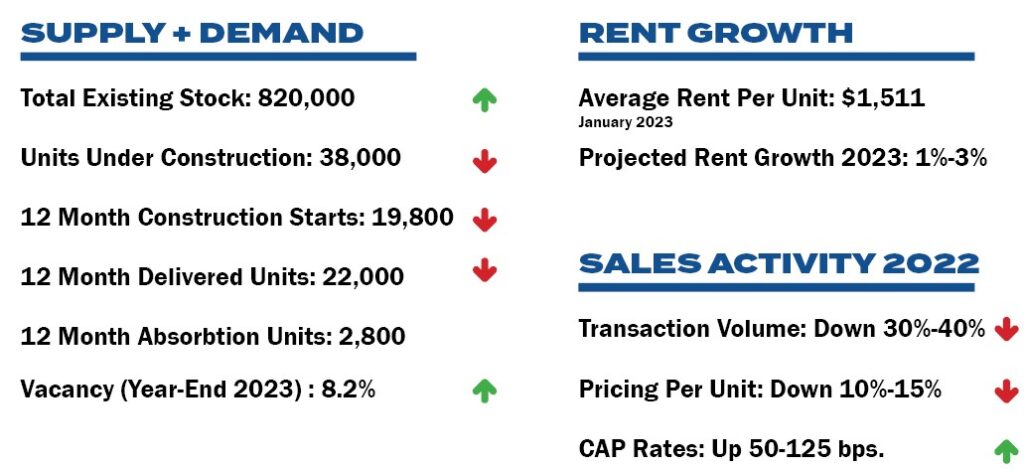

We were hoping the first half of the year would exceed expectations since the bar was low starting the first of the year… this did not happen. The high interest rate environment has wreaked havoc on the transaction markets and the adjustment period between Buyers and Sellers has still not stabilized. It appears that the pause in interest rate hikes and eventual downward trend has been pushed back, stalling any sort of quick bounce back toward the activity we saw in 2021—2022.

Until we get some relief from these higher rates, cap rates will continue adjusting upwards and property values will continue declining. In addition to this there are other challenges the CRE industry faces, i.e. large increases in property taxes and insurance, increased bad debt, and slowing rent growth.

It looks like 2023 will end up being the transition year, where the CRE industry adjusts to this new higher interest rate environment.

Looking Forward

We expect the 2nd half of this year to be more of the same with regards to sales activity “slow”, but thinking the pipelines for new transactions will get better toward the end of the year, setting us up for a better start to 2024.

In the meantime, while this adjustment period plays out, most owners are focused on operations and less concerned about Buying or Selling unless that “right opportunity” comes along. Those owners who have debt coming due will have their hands full trying to find replacement debt or facing the hard fact of bringing in additional equity or maybe selling in today’s market. On the buy side of things, there are still plenty of active Buyers who are looking for opportunities albeit with more conservative underwriting and revised expectations. Developers also face challenges as financing is much harder to get, pushing back many planned development deals.

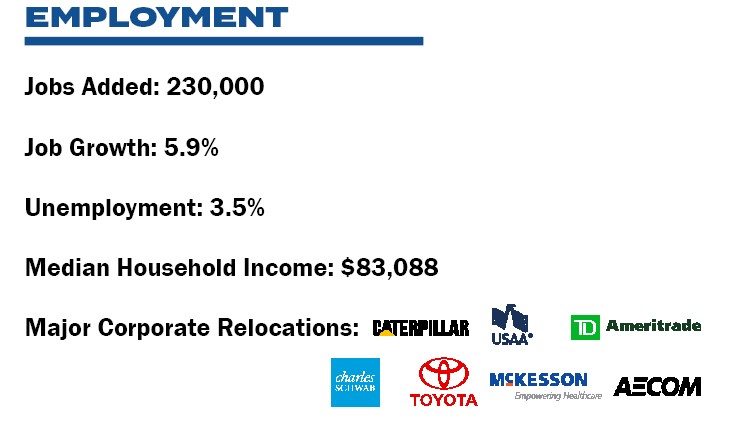

Not everything is bad, there is still good news looking forward. Texas and the metroplex still lead the country in fundamentals with healthy job growth and continued inward migration that should keep apartment demand intact and stable.

Multi-family is still the preferred asset type and the metroplex is still the place to be.