A Recap of 2022 & What We Could Be Facing in 2023

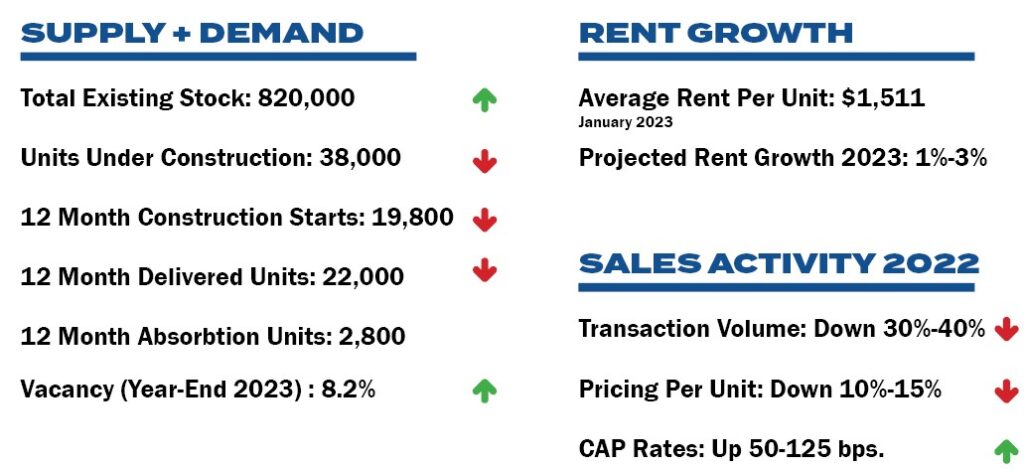

2022 was going to have a hard time keeping up with the record performance of 2021 but we had a great start to the year, which ended up as a tale of two stories. The days of low interest rates, record transaction activity, too much capital chasing too few deals, record prices and a market with more demand for housing than supply, seemed to be in the rear-view mirror as the year progressed. It didn’t take long to realize that inflation was not transitory and that the Fed was going to have to increase interest rates to bring inflation in. What was not expected is the rate at which these increases would take place and toward the end of the year it became obvious that these rate increases were going to have a profound impact on CRE. Prior to the rate increases, many Buyers had committed to floating rate bridge loan debt with short maturities, which is still playing out. The amount of inventory now outpaces demand resulting in an increase in vacancy and a tapering off of the double-digit rent increases that were driving the market.

It takes time for the market to digest these changes and it appears as though many investors are taking the “wait and see” approach to future investments, hoping for a little more clarity as we move in to 2023.

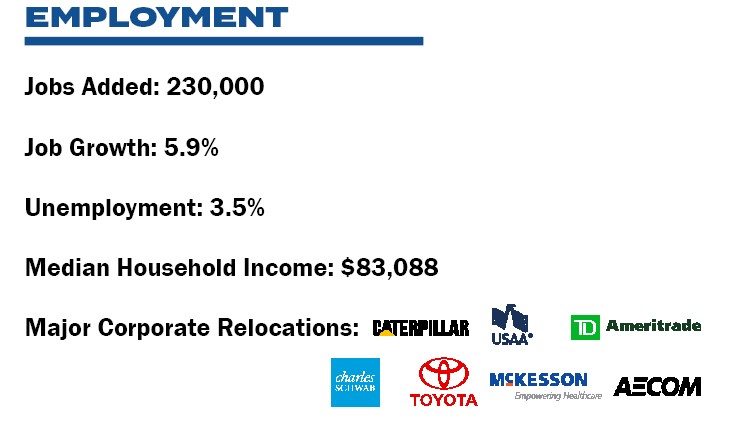

2023 will have a much more cautious outlook for most, and the consensus seems to be less activity for both Buyers and Sellers in 2023. Having said this, multifamily is still the “darling” of real estate investments and DFW is still at the top of everyone’s list. Texas has so much to offer, and the latest statistics show that employment grew by over 5% in 2022 as we added over 650,000 jobs to the labor force, more than double the historical average. North Texas faired even better with 5.9% growth and over 230,000 jobs added to the labor force. For perspective, Texas far outpaced any other state in the country.

The wild card is whether or not we enter a recession and how long and deep. Most think any recession will be shallow and short lived and that activity in the 2nd half of the year will start to pick back up. The party’s not over yet, as Texas has too many good fundamentals in place that will fuel continued growth.